With the stock market’s volatility and the year coming to an end, it’s a good time to review how you, as an individual, are taxed on the gains and losses from your investments.

According to the IRS, nearly everything you own and use for personal or investment purposes is a capital asset. This includes a home, personal-use items like household furnishings, and stocks or bonds held as investments.

Capital Gains and Losses: Long-term vs. Short-Term

First, separate your long-term gains and losses from your short-term gains and losses.

Long-term: gains or losses from investments you held for more than a year.

Short-term: gains and losses from investments held for one year or less.

Capital Gain Tax Rates

According to the IRS, the tax rate on most net capital gains is no higher than 15% for most individuals. Some or all net capital gains may be taxed at 0% if your taxable income is less than $80,000.

Tax Rate Grouping for Capital Gains and Losses

Your long-term gains and losses are separated into three rate groups:

Capital Gains & Losses: 28% Tax Rate

- Capital gains and losses from collectibles (including works of art, rugs, antiques, metals, gems, stamps, coins, and alcoholic beverages) held for more than one year

- Long-term capital loss carryovers

- Section 1202 gain (gain from the sale of certain small business stock held for more than five years)

Capital Gains: 25% Tax Rate

- This includes the “unrecaptured section 1250 gain,” which is gain on the sale of depreciable real property that’s attributable to the depreciation of that property

Capital Gains & Losses: 20%/15%/0% Tax Rate Grouping

- Consists of long-term capital gains and losses that don’t fit other tax rate groupings

- Most gains and losses from assets held for more than one year

Netting and Ordering Rules

Within each of the three tax rate groups, gains and losses are calculated to arrive at a net gain or loss, based on the following rules:

- Short-term capital losses are applied first to reduce any short-term capital gains, which are otherwise taxable at ordinary rates.

If you have a net short-term capital loss, it reduces any net long-term gain from the 28% group, then the 25% group, and from the 20%/15%/0% group. - Long-term capital gains and losses: a net loss from the 28% group (including long-term capital loss carryovers) is used first to reduce gain from the 25% group, then to reduce net gain from the 20%/15%/0% group.

A net loss from the 20%/15%/0% group is used first to reduce gain from the 28% group, then to reduce gain from the 25% group.

After your have completed netting, if you have any long-term capital gain, then it will be taxed at the rate of its grouping.

This is how the tax rates apply in the 20%/15%/0% group:

0% Capital Gains Tax Rate

This 0% applies to gains that would otherwise be taxed at a regular tax rate below the “maximum zero rate amount.”

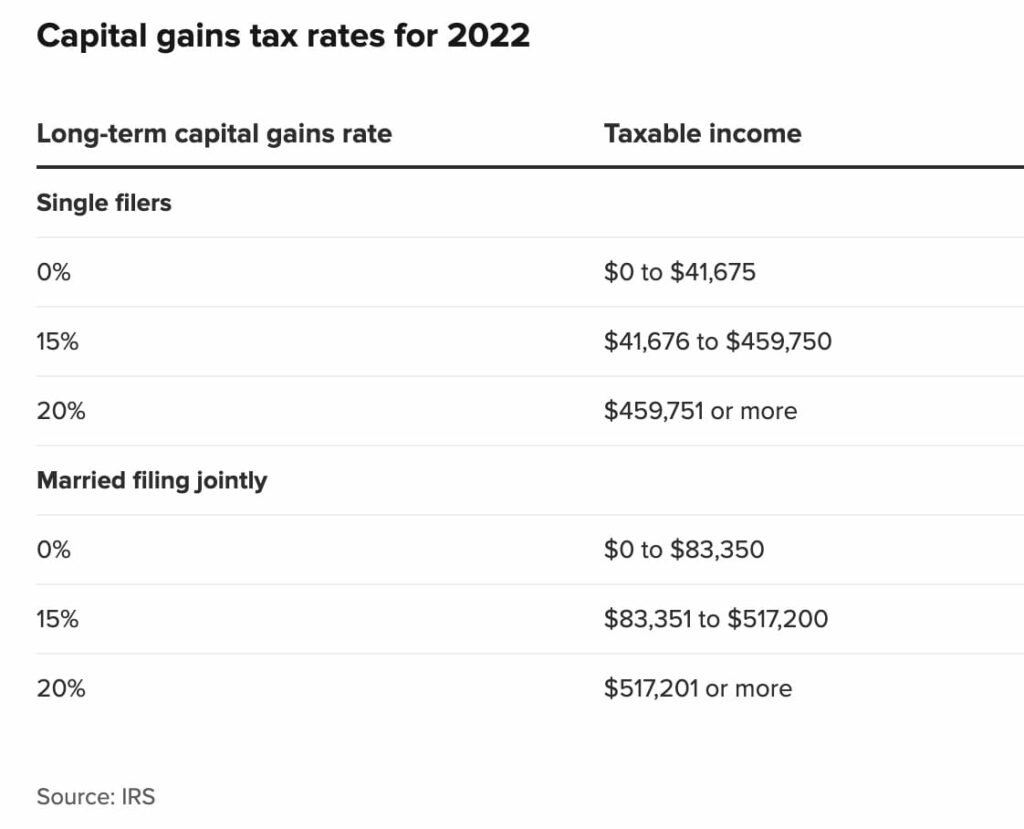

For 2022, the 0% tax rate applies to adjusted net capital gain of up to: $83,350 for joint filers and surviving spouses; $55,800 for heads of household; $41,675 for single filers and for married taxpayers filing separately.

15% Capital Gains Tax Rate

The 15% applies in the case of gain that otherwise would be taxed at a regular tax rate below the maximum 15% rate amount.

For 2022, the 15% tax rate applies to adjusted net capital gain over the amount subject to the 0% rate, and up to: $517,200 for joint filers; $258,600 for married taxpayers filing separately; $473,750 for heads of household, and $459,750 for single filers.

20% Capital Gains Tax Rate

This 20% rate applies to gain that otherwise would be taxed in excess of the amount subject to the 15% rate.

A 3.8% tax on net investment income applies to taxpayers with modified adjusted gross income (MAGI) that exceeds $250,000 for joint returns, $200,000 for single taxpayers and heads of household, or $125,000 for married taxpayers filing separately. Net investment income includes, among other things, taxable interest, dividends, gains, passive rents, annuities, and royalties.

After the 3.8% tax is factored in, the top rate on capital gain is 23.8%.

Offsetting Ordinary Income with Capital Gain Losses

If, after the above netting, you’re left with short-term losses or long-term losses (or both), you can use the losses to offset ordinary income, subject to a limit.

The maximum annual deduction against ordinary income for the year is $3,000 ($1,500 for married taxpayers filing separately).

Any loss not absorbed by the deduction in the current year is carried forward to later years, until all of it is either offset against capital gains or deducted against ordinary income in those years, subject to the $3,000 limit.

If you have both net short-term losses and net long-term losses, the net short-term losses are used to offset ordinary income before the net long-term losses are used.

Capital Gains Tax Planning Suggestions

Since losses can only be used against gains (or up to $3,000 of ordinary income), in many cases, matching up gains and losses can save you taxes.

For example, suppose you’ve already realized $20,000 in capital gains this year and are holding investments on which you’ve lost $20,000. Assuming you have no other gains or losses, if you sell the loss items before the end of the year, they will absorb the gains completely. If you wait to sell the loss items next year, you’ll be fully taxed on this year’s gains and will only be able to deduct $3,000 of your losses next year.

Another technique is to seek to “isolate” short-term gains against long-term losses.

For example, say you have $10,000 in short-term gains in Year 1 and $10,000 in long-term losses as well. You’re in the highest tax bracket in all relevant years (assume that’s a 37% bracket for Year 1). Your other investments have been held more than one year and have gone up $10,000 in value, but you haven’t sold them. If you sell them in Year 1, they will be netted against the long-term losses and leave your short-term gains to be taxed at 37%.

Alternatively, if you can hold off and sell them in Year 2 (assuming no other Year 2 transactions), the losses will “absorb” the short-term gains in Year 1. In Year 2, the long-term gains will then be taxed at only 20% (unless the gains belong in the 25% or 28% group).

More Information

If you have questions, contact us to discuss your situation.

To check out our other articles on business topics, click here.

Debra Annis

Debra Annis brings 40+ years of experience in accounting and tax. She helps clients overcome obstacles with cash flow, planning, stability and growth. She enjoys working with clients to find solutions that achieve their plans and avoid paying unnecessary tax.

About Smith Patrick CPAs

Smith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. For over 30 years, our firm has focused on providing excellent service to business owners and high-net worth families across the country. Investment Advisory Services are offered through Wealth Management, LLC, a Registered Investment Advisor.