The Internal Revenue Service recently announced a mid-year mileage rate increase, used for calculating business tax deductions for vehicle use. This rare mileage increase is in response to increasing gasoline prices, which have hit all-time highs.

New Mileage Rate

The new IRS mileage rate for the final six months of 2022 will be 62.5 cents a mile, up from 58.5 cents a mile. This is a 4 cent increase from the rate effective at the start of the year.

The new rate for deductible medical or moving expenses (available for active-duty members of the military) will be 22 cents for the remainder of 2022, also up 4 cents from the rate effective at the start of 2022.

Reasons & Date Effective

These new rates become effective July 1, 2022. The IRS normally updates the mileage rates once a year in the fall for the next calendar year. For travel from January 1 through June 30, 2022, taxpayers should use the initial mileage rates for 2022.

According to the IRS, while fuel costs are a significant factor in the mileage figure, other items enter into the calculation of mileage rates, such as depreciation and insurance and other fixed and variable costs.

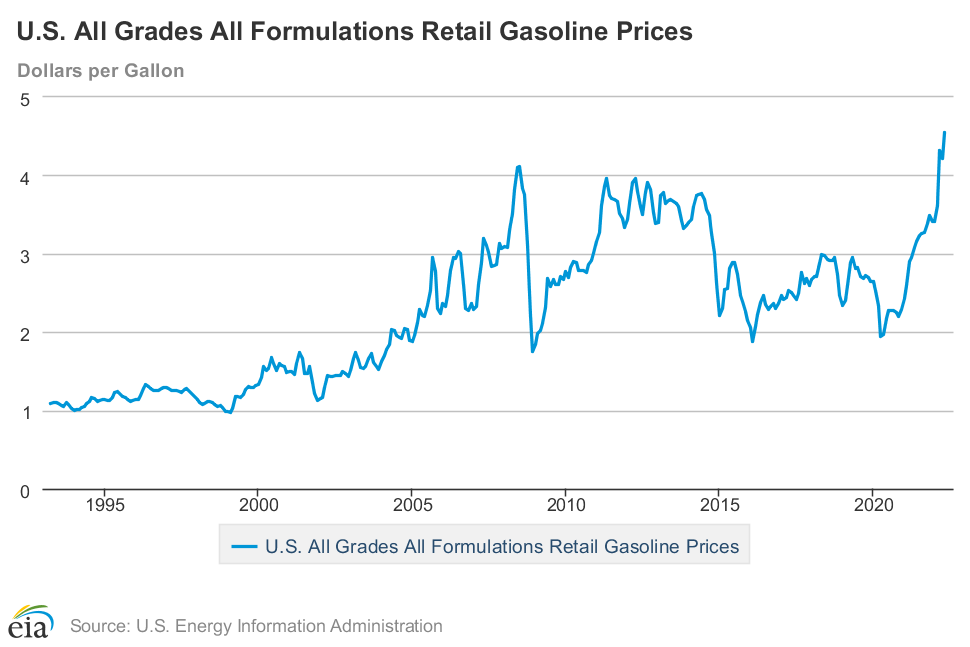

This mid-year increase also comes after two letters from members of Congress to IRS Commissioner Charles Rettig requesting it because of sharp fuel price increases this year. The Congressional letters stated that the nationwide retail average of gasoline fuel has risen from $3.40 per gallon in December 2021 to $4.30 per gallon in March 2022.

The trajectory of gas prices is documented in this graph on the website of the U.S. Energy Information Administration (EIA).

How is the IRS Mileage Rate Used?

The optional business standard mileage rate is used to compute the deductible costs of operating an automobile for business use in lieu of tracking actual costs. This rate is also used as a benchmark by the federal government and many businesses to reimburse their employees for mileage.

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

Mileage for Charitable Organizations Unchanged

The 14 cents per mile rate for charitable organizations remains unchanged as it is set by statute.

Midyear increases in the optional mileage rates are rare, the last time the IRS made such an increase was in 2011.

Mileage Rate Changes

| Purpose | Rates 1/1 through 6/30/2022 | Rates 7/1 through 12/31/2022 |

|---|---|---|

| Business | 58.5 | 62.5 |

| Medical/Moving | 18 | 22 |

| Charitable | 14 | 14 |

For more information, read the IRS mileage news release.

More Information

If you have questions, contact us to discuss your situation.

To check out our other articles on business topics, click here.

Patty Ward

Patty has more than 30 years experience in public accounting. She reviews tax returns for high net worth clients, focusing on individual tax work. Her mission is to provide high level service to her clients, reducing their tax burdens, keeping them informed and instilling confidence.

About Smith Patrick CPAs

Smith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. For over 30 years, our firm has focused on providing excellent service to business owners and high-net worth families across the country. Investment Advisory Services are offered through Wealth Management, LLC, a Registered Investment Advisor.