If you’re making energy-efficient improvements to your home, you’ll want to pay attention to the newly passed Inflation Reduction Act. This new law expands or extends tax credits.

Taxpayers who improve their homes to be more green, or energy-efficient, should review a host of tax credits from the new law.

Energy Efficient Home Improvement Credit

The Nonbusiness Energy Property Credit was extended through 2032 and renamed the Energy Efficient Home Improvement Credit.

What You Need to Know about This Tax Credit

- The $500 per lifetime limit on the total credit amount will be replaced with a $1,200 limit per year

- Applies to property placed in service after Dec. 31, 2022. Credit is extended through Dec. 31, 2032

- Starting in 2023, the credit is capped to the lesser of either: 30 percent of the costs of all eligible home improvements made during the year (except heat pumps) or $1200 total

- If your utility company offers a rebate for installing energy-efficient improvements, deduct that rebate from your cost before calculating the 30% tax credit

- Energy Star will be updating the information on future tax credits after 2022.

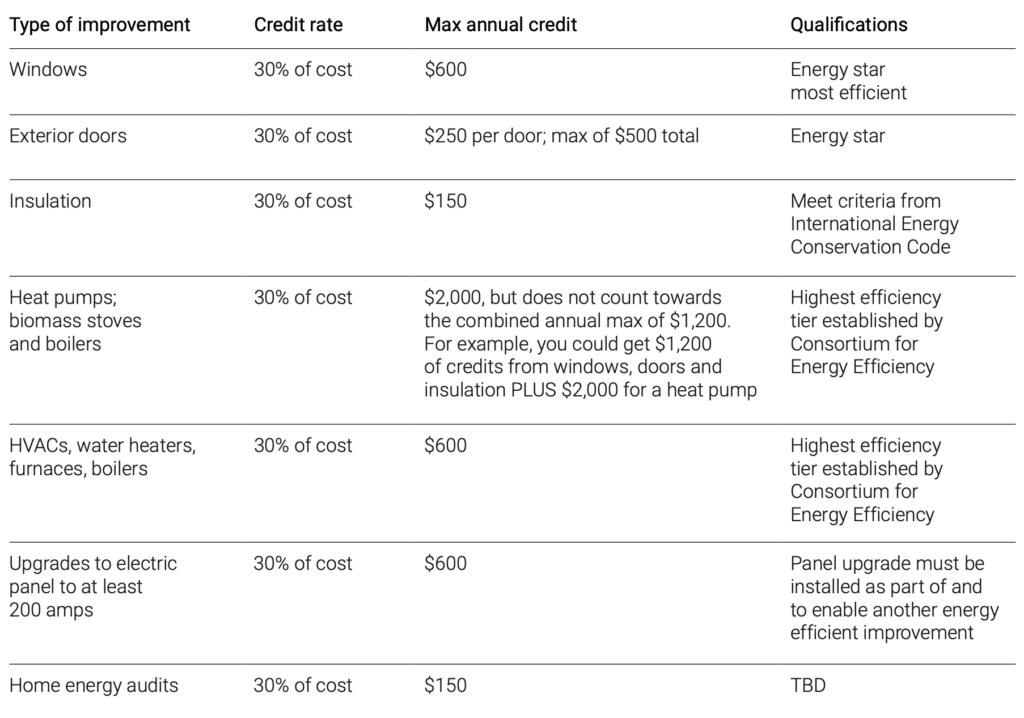

Annual Tax Credit Limits for Specific Qualifying Home Improvements

Note: the annual maximum credit of $1,200 applies across all categories combined (except heat pumps).

- $150 for home energy audits

- $250 for any exterior door ($500 total for all exterior doors) that meet applicable Energy Star requirements

- $600 for exterior windows and skylights that meet Energy Star most efficient certification requirements

- $600 for other qualified energy property, including central air conditioners; electric panels and certain related equipment; natural gas, propane, or oil water heaters; oil furnaces; water boilers;

- $2,000 for heat pump and heat pump water heaters; biomass stoves and boilers. This category of improvement is not limited by the $1,200 annual limit on total credits or the $600 limit on qualified energy property; and

- Roofing will no longer qualify.

For eligible home improvements using products placed in service after 2024, no credit will be allowed unless the manufacturer of any purchased item creates a product identification number for the product and the taxpayer claiming the credit includes the number on his or her return for that tax year.

Residential Clean Energy Credit

The Residential Energy Efficient Property Credit, now called the Residential Clean Energy Credit, was previously scheduled to expire at the end of 2023 but has been extended through 2034. The Inflation Reduction Act also increased the credit amount, with a phaseout of the applicable percentage.

Amount of Credit

- 30 percent for 2023-2032

- 26 percent for 2033

- 22 percent for 2034

The credit no longer applies to biomass furnaces and water heaters, now covered under the Energy Efficient Home Improvement Credit. Starting in 2023, however, the new credit will apply to battery storage technology with a capacity of at least three kilowatt hours.

More Information

If you have questions, contact us to discuss your situation.

To check out our other articles on business topics, click here.

Alan Dierker

Alan Dierker is a Tax Manager with experience in tax, outsourced controller services, including fulfilling compilation and preparation agreements, payroll and compliance issues. He also has experience in the following industries: Wholesale Distribution, Private Foundations, Not-for-Profit and Real Estate.

About Smith Patrick CPAs

Smith Patrick CPAs is a boutique, St. Louis-based, CPA firm dedicated to providing personal guidance on taxes, investment advice and financial service to forward-thinking businesses and financially active individuals. For over 30 years, our firm has focused on providing excellent service to business owners and high-net worth families across the country. Investment Advisory Services are offered through Wealth Management, LLC, a Registered Investment Advisor.